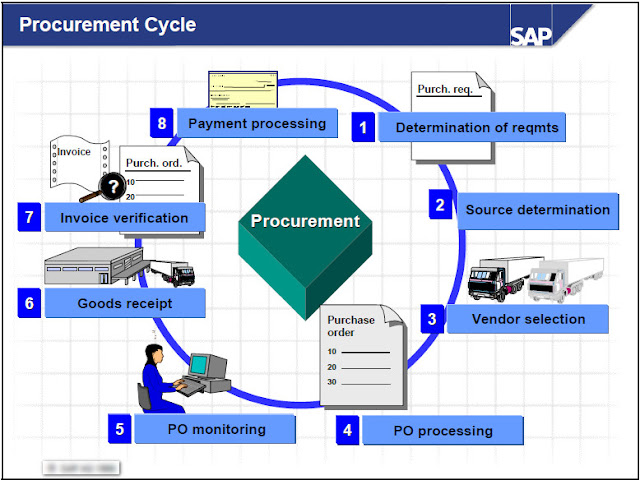

Basic Procurement process also known as Procure to Payment (P2P) Cycle.

SAP Procure to Pay process is required when we need to purchase materials/services from an external vendor for our company. This process includes all the business tasks starting from a purchase requisition (PR) and finishing with payment to the vendor.

The Procure to Payment process is generally segmented into 6 sub-processes: Master Data Maintenance, Requisition Processing, Sourcing, Purchase Order Processing, Goods Receiving and Accounts Payable Management.

In SAP following steps are including in P2P Cycle.

1. Determination of requirements: The process typically begins with the identification of a material requirements. The user department responsible can manually pass a requirement for materials to the Purchasing department via a purchase requisition.

Purchase Requisition Can be create Two ways

Directly - Manually : Persons create determines what, which Quantity and when required.

Indirectly - Automatically : MRP , Production Order, Maintenance Order, Sales Orders

2. Determination of the source of supply: The SAP System helps the buyer determine possible sources of supply. You can use determination of the source of supply to create requests for quotation (RFQs) and then enter the quotations. You can also access existing purchase orders and conditions in the system.

3. Vendor selection: The system simplifies the selection of vendors by making price comparisons between the various quotations. It automatically sends rejection letters.

4. Purchase order processing: The system facilitates data entry by providing entry aids when you are entering purchase orders. A purchase order is a formal request to a vendor to supply you with goods or services at the conditions stated in the purchase order. You specify in the purchase order whether the material is delivered for stock or for direct consumption (for example, cost center, asset or project). The goods receipt and invoice verification are usually carried out on the basis of the purchase order.

5. Purchase order monitoring: The buyer can monitor the processing status of the purchase order online at any time and can determine whether goods or an invoice have been received for the relevant purchase order item. The system also supports reminder procedures.

6. Goods receipt: The system compares the goods receipt quantity with the purchase order quantity.

When you enter incoming deliveries (by looking at the delivery order provided by vendor), you will be referring to the Purchase Order, therefore, entry work is minimized. SAP is also able to check how much quantity is still open for receiving, and it is also possible to set tolerance levels.

For example,

3. Vendor selection: The system simplifies the selection of vendors by making price comparisons between the various quotations. It automatically sends rejection letters.

4. Purchase order processing: The system facilitates data entry by providing entry aids when you are entering purchase orders. A purchase order is a formal request to a vendor to supply you with goods or services at the conditions stated in the purchase order. You specify in the purchase order whether the material is delivered for stock or for direct consumption (for example, cost center, asset or project). The goods receipt and invoice verification are usually carried out on the basis of the purchase order.

5. Purchase order monitoring: The buyer can monitor the processing status of the purchase order online at any time and can determine whether goods or an invoice have been received for the relevant purchase order item. The system also supports reminder procedures.

6. Goods receipt: The system compares the goods receipt quantity with the purchase order quantity.

When you enter incoming deliveries (by looking at the delivery order provided by vendor), you will be referring to the Purchase Order, therefore, entry work is minimized. SAP is also able to check how much quantity is still open for receiving, and it is also possible to set tolerance levels.

For example,

If your Purchase Order quantity is 100, you can set a over delivery and/or under delivery tolerance. Therefore, system will check against the tolerance % that you have set, and if you enter a quantity that exceeds this, SAP will throw you an error message.

7. Invoice verification: Vendor invoices are checked for accuracy of prices and contents.

This process of verifying invoice and paying to vendor is known as invoice verification.

7. Invoice verification: Vendor invoices are checked for accuracy of prices and contents.

When performing Invoice Verification in SAP, you will be referring to either the Purchase Order or Goods Receipt document. SAP will perform the necessary checks to ensure that you do not over or under pay the Vendor. Once this is completed, the MM Cycle is over. The next step "Payment Processing" is under the FI Module.

8. Payment processing: Financial Accounting normally deals with vendor payments.

8. Payment processing: Financial Accounting normally deals with vendor payments.